|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

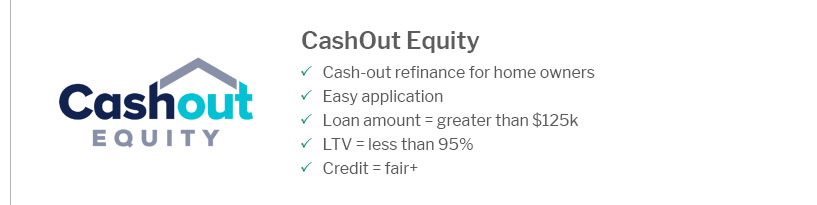

Understanding What is Refinance Home Loan and Its BenefitsA refinance home loan is an option that homeowners consider for various reasons. It involves replacing an existing mortgage with a new one, typically to secure better terms or rates. Reasons to Consider RefinancingThere are several compelling reasons why homeowners might decide to refinance their home loans. Lower Interest RatesOne of the most common motivations is to take advantage of washington refinance mortgage rates that may be lower than the original mortgage. This can significantly reduce monthly payments and overall interest paid. Changing Loan TermsHomeowners might wish to change the duration of their loan, for instance, moving from a 30-year mortgage to a 15-year one, which can lead to faster equity building. Accessing Home EquityRefinancing can also provide access to home equity, offering funds for major expenses like home renovations or education. Potential Costs InvolvedWhile refinancing can offer savings, it is important to be aware of the potential costs involved.

For a detailed understanding of the expenses, you can explore what does a mortgage refinance cost. Steps to Refinance Your Home Loan

FAQWhat are the benefits of refinancing a home loan?Refinancing can offer several benefits including lower monthly payments, reduced interest rates, and the ability to change loan terms or access home equity. How often can you refinance a home loan?There is technically no limit to how often you can refinance. However, you should consider the costs and benefits each time to ensure it makes financial sense. Does refinancing affect your credit score?Refinancing can temporarily affect your credit score due to credit inquiries and changes in credit utilization, but typically, these effects are short-lived. https://www.youtube.com/watch?v=IqHoknp1OCA

Refinancing a mortgage involves taking out a new loan to pay off your original mortgage loan. Here's how to refinance a mortgage. https://www.tvacreditunion.com/borrow/loans/home-refinance.html

REFINANCE? Refinancing a home loan is when you get a new home loan1, 2 or mortgage loan1, 2 to replace your current one. The most common reasons to refinance a ... https://www.hsbc.com.au/home-loans/refinance/what-is-refinancing-a-home-loan/

When you refinance your home loan, you are replacing your existing mortgage with a new one. Often it's because your financial situation and goals have ...

|

|---|